ETF Asset Allocation Update | November 2025

Grow Your Pile – Portfolio #3 (ETF Focused)

🟩 Grow Your Pile – Portfolio #3

ETF Asset Allocation Update | November 2025

Hello Investors,

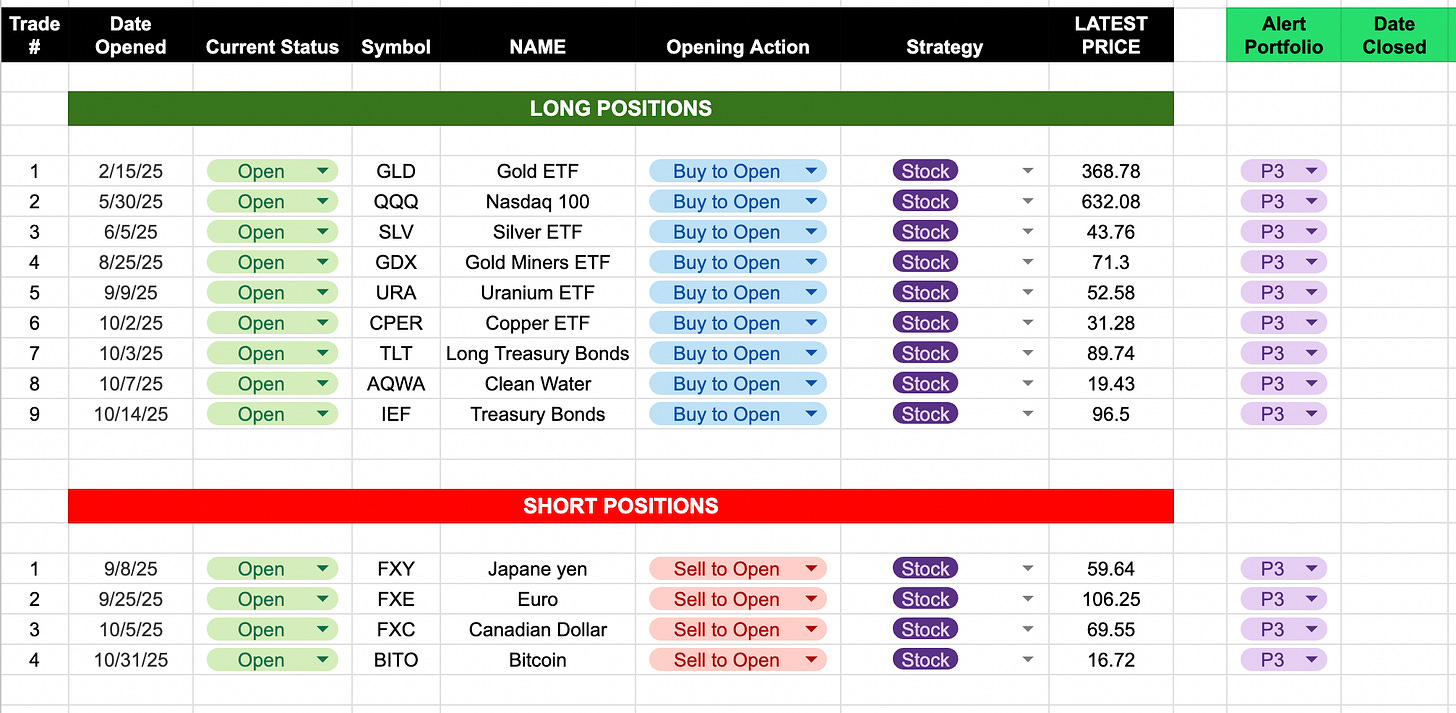

As part of our ongoing Grow Your Pile updates, below is the latest snapshot of Portfolio #3 — our diversified ETF allocation strategy.

This portfolio is built to balance growth and protection across key global asset classes, with disciplined exposure to both long and short macro themes.

📊 Current Positioning

Our long positions emphasize real assets, technology, and fixed income exposure — reflecting our belief that gold, silver, and uranium remain valuable inflation hedges while the Nasdaq 100 continues to show relative strength.

We also maintain exposure to long-duration Treasuries (TLT, IEF) to benefit from potential rate-stabilization and deflationary trends.

On the short side, we’re positioned against select currencies and speculative assets — including the Japanese Yen, Euro, Canadian Dollar, and Bitcoin — as part of our tactical hedge against macro-volatility and dollar strength.

(Full list of current holdings attached below.)

🧭 Portfolio Objective

Portfolio #3 seeks to:

Preserve capital through diversification across uncorrelated assets

Capture upside during commodity and equity expansions

Protect downside via defensive and contrarian short exposures

Maintain liquidity and transparency through ETF vehicles

📰 Market Note

Markets have entered a transition phase — inflation pressures are easing, but volatility in rates and currencies remains elevated.

Our positioning continues to reflect a barbell approach: balancing hard-asset strength (Gold, Silver, Uranium) with defensive yield exposure (Treasuries and Clean Water ETF).

We’ll continue to monitor macro signals closely and adjust exposures as opportunities evolve.

Stay focused. Stay patient. Grow your pile.

Warm regards,

Tony Rihan

Grow Your Pile | ETF Portfolio #3

📧 info@growyourpile.com | 🌐 www.growyourpile.com