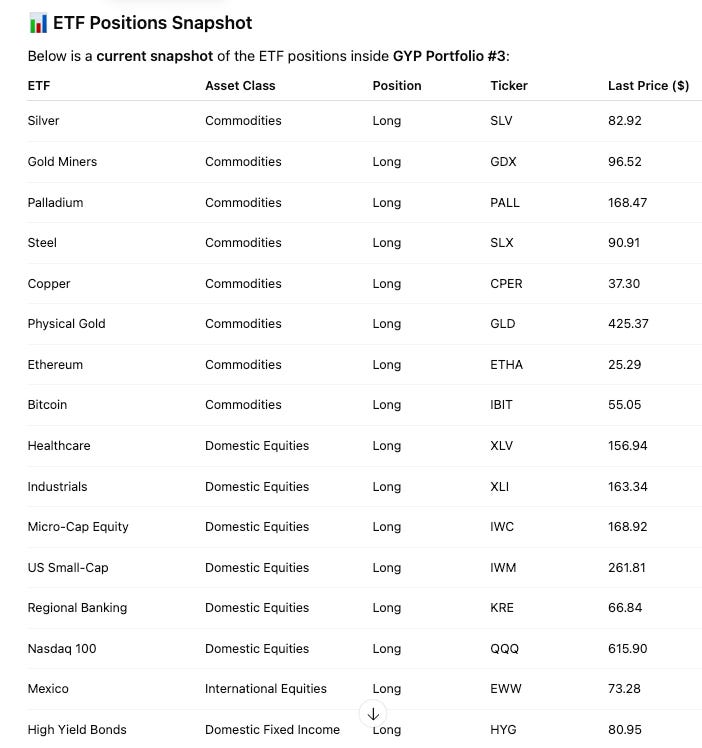

FREE Sneak Peek! GYP Portfolio #3: ETF Income & Growth Alerts

ETF Semi-Active to Passive | Starting from $20K+

One of the questions we get most often at Grow Your Pile is simple:

“What does a well-built ETF portfolio actually look like when you’re not trying to trade every day?”

Portfolio #3 — GYP: ETF Income & Growth Alerts — is our answer.

This portfolio is designed for investors who want:

Broad diversification

Inflation awareness

Global exposure

Low maintenance

And the ability to scale from $20,000 upward

It sits comfortably between passive investing and light, disciplined adjustments when macro conditions change.

🧠 Portfolio Construction Philosophy

This portfolio is built around four core pillars:

1️⃣ Real Assets & Inflation Hedges

We intentionally overweight real assets that tend to perform well during inflationary or currency-debasement environments.

Precious metals (Gold, Silver, Gold Miners)

Energy & materials (Oil services, Steel, Copper)

Bitcoin exposure as a modern, asymmetric hedge

These positions are not trades — they’re strategic allocations meant to protect purchasing power over time.

2️⃣ Core U.S. Equity Growth

We maintain exposure to the engines of U.S. economic growth:

Large-cap equities

Nasdaq / innovation

Mid-cap and small-cap participation

Healthcare for defensive growth

This ensures the portfolio continues to benefit from productivity, earnings growth, and long-term compounding.

3️⃣ International Diversification

True diversification means going beyond U.S. borders.

We include:

Mexico for near-shoring and demographic growth

Broad international exposure to reduce single-country risk

This helps smooth volatility and reduces over-reliance on any one economy.

4️⃣ Income & Stability

Finally, we balance growth with income-oriented ETFs:

High-yield bonds

Regional banks

Dividend-focused exposures

These positions help:

Reduce volatility

Generate cash flow

Improve portfolio durability during market drawdowns

⚙️ How This Portfolio Is ManagedNot day-traded

Not ignored

Reviewed through a macro and risk lens

Adjusted only when conditions truly change

Think of it as:

“A portfolio you can live with — and stick with.”

🔍 Why We Like Portfolio #3

✔️ Scales cleanly from $20K to $1M+

✔️ Designed for real-world investors, not traders

✔️ Balanced between growth, income, and protection

✔️ Built to survive inflation, recessions, and regime shiftsMost portfolios fail not because of bad assets —

but because they are over-traded, over-levered, or poorly diversified.GYP Portfolio #3 is about staying invested, staying balanced, and letting time do the heavy lifting.

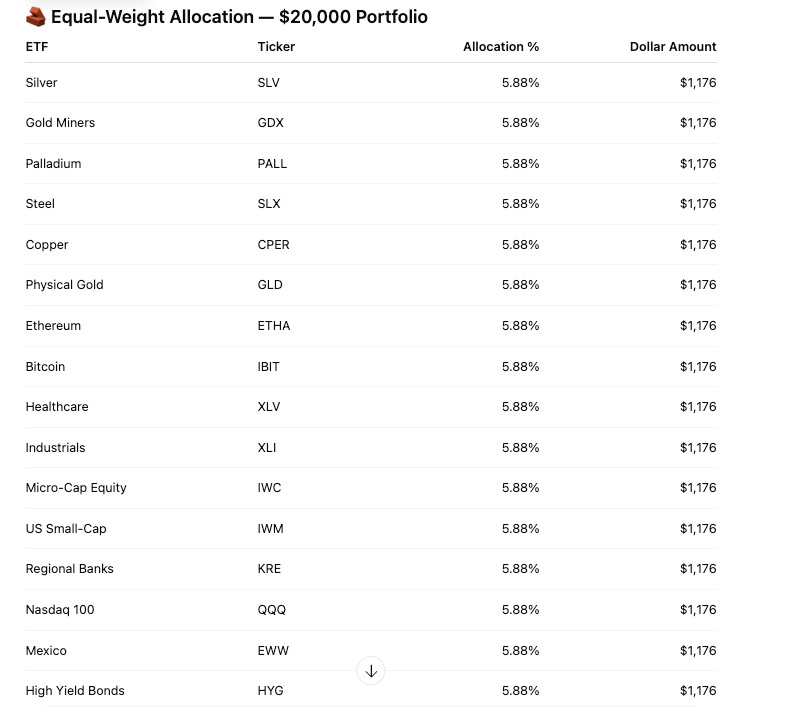

Following is a clean, equal-weight model allocation for GYP Portfolio #3 at $20K, $50K, and $100K.

This is designed to be:

Simple

Scalable

Easy to rebalance

And realistic for real investors (not institutional math gymnastics)

⚖️ Equal-Weight Framework

Number of ETFs: 17

Weight per ETF: ~5.88% each

Philosophy: No forecasting, no hero calls — diversification first

🧱 Equal-Weight Allocation — $50,000 PortfolioETFTickerAllocation %Dollar AmountAll 17 ETFs—5.88% each~$2,941 per ETF

Total Portfolio: $50,000

This size allows:

Full ETF exposure

Easier tax-loss harvesting

Cleaner quarterly rebalancing

🧱 Equal-Weight Allocation — $100,000 Portfolio

ETFTickerAllocation %Dollar AmountAll 17 ETFs—5.88% each~$5,882 per ETF

Total Portfolio: $100,000

At this level, the portfolio becomes:

Very stable

Highly diversified

Suitable for light tactical tilts (later, not required)

🔁 Rebalancing Rules (Simple & Realistic)

Frequency: 1–2x per year

Trigger:

Any ETF drifts ±25–30% from its target weight

Method: Trim winners → add to laggards

Goal: Control risk, not maximize short-term returns

🧠 Why Equal Weight Works Here

✔️ Avoids concentration risk

✔️ Forces discipline

✔️ Naturally sells high / buys low

✔️ Works across market regimes

✔️ Easy to understand and executeEqual weight removes emotion — and emotion is what destroys portfolios.

📌 Optional Future Enhancements (Not Required)

Later versions of Portfolio #3 may introduce:

Slight core tilts (QQQ, GLD, XLV)

Volatility-aware overlays

Income-weighted sleeve

Or tax-efficient rebalancing

But the base model always starts here.

Final Thought

If someone can stick to this portfolio for years —

they’re already ahead of 90% of investors.Simple.

Balanced.

Durable.